In any divorce or separation, one of the key issues to consider is spousal support and alimony. Spousal support, also known as alimony, refers to the financial assistance that one spouse may be required to provide to the other after the dissolution of their marriage. Understanding the legal rights and obligations surrounding spousal support and alimony is essential to ensure a fair and just resolution.

Understanding Spousal Support and Alimony

Before delving into the roles of best family lawyers, it is important to define what spousal support and alimony entail. Spousal support is a payment made by one spouse to the other to provide financial support following a divorce or separation. It is typically based on the principle of fairness, aiming to help the lower-earning spouse maintain a standard of living similar to that enjoyed during the marriage.

Spousal support and alimony can take various forms depending on the specific circumstances of the divorce. These may include regular payments, lump-sum amounts, or the transfer of assets. The exact terms and amount of support are determined by a combination of factors including the duration of the marriage, the income disparity between the spouses, and the financial needs of both parties. Learn more about legal procedures of adoption and guardianship.

The purpose of spousal support and alimony is to address any inequalities that may arise from the end of a marriage, particularly in situations where one spouse might have sacrificed their own career or education opportunities to support the other. It aims to provide financial stability during the transition period and enable both parties to maintain a certain standard of living after the divorce.

When determining the amount of spousal support or alimony, the court considers various factors such as the length of the marriage, the age and health of the parties involved, the earning capacity of each spouse, and the standard of living established during the marriage. The court also takes into account any child support obligations and the financial resources of each spouse.

It is important to note that spousal support and alimony laws vary from jurisdiction to jurisdiction. Some states have specific guidelines and formulas to calculate the amount and duration of support, while others allow judges more discretion in making these decisions. Additionally, the tax implications of spousal support and alimony can also vary, with some jurisdictions treating it as taxable income for the recipient and a tax deduction for the payer.

In cases where the paying spouse experiences a significant change in financial circumstances, such as job loss or a decrease in income, they may petition the court for a modification of the spousal support or alimony order. Similarly, the recipient spouse may seek a modification if their financial needs change or if they become self-supporting.

It is worth mentioning that spousal support and alimony are not permanent in most cases. The duration of support can vary depending on the length of the marriage and other factors. In some instances, the court may set a specific end date for support payments, while in others, it may be left open-ended, subject to review and modification as circumstances change.

Overall, spousal support and alimony play a crucial role in providing financial stability and addressing the economic disparities that can arise from the end of a marriage. They aim to ensure fairness and help both parties transition into their post-divorce lives with a certain level of financial security.

Legal Rights in Spousal Support and Alimony

Each spouse involved in a divorce has specific rights concerning spousal support and alimony. Understanding these rights is crucial to ensure a fair outcome:

Rights of the Paying Spouse

The paying spouse has the right to have their financial circumstances and ability to pay taken into consideration when determining the amount of spousal support. This means that if the paying spouse is facing financial hardships, such as job loss or significant debt, the court will consider these factors and may adjust the amount of support accordingly. It is important for the paying spouse to provide accurate and detailed financial information to the court to ensure a fair assessment.

In addition, the paying spouse also has the right to request modifications or termination of support if there is a significant change in their financial situation. For example, if the paying spouse experiences a substantial increase in income or if their financial responsibilities change, they can petition the court to modify or terminate the spousal support order. However, it is essential for the paying spouse to provide evidence of the changed circumstances and demonstrate that the modification is justified.

Rights of the Receiving Spouse

The receiving spouse has the right to receive adequate financial support to maintain a reasonable standard of living following the divorce. This means that the court will consider various factors, such as the receiving spouse’s income, earning capacity, and financial needs, when determining the amount of spousal support. The goal is to ensure that the receiving spouse can continue to meet their basic living expenses and maintain a similar lifestyle to what they had during the marriage.

Furthermore, the receiving spouse has the right to seek enforcement of support orders. If the paying spouse fails to make the required spousal support payments, the receiving spouse can take legal action to enforce the order. This may involve seeking wage garnishment or other methods of collecting the owed support. It is important for the receiving spouse to keep detailed records of the missed payments and communicate with their attorney to explore the available options for enforcement.

Additionally, the receiving spouse also has the right to request modifications if there are changes in their own financial circumstances. For instance, if the receiving spouse experiences a significant decrease in income or faces unexpected financial burdens, they can petition the court to modify the spousal support order. It is crucial for the receiving spouse to provide evidence of the changed circumstances and demonstrate that the modification is necessary to maintain a reasonable standard of living.

Legal Obligations in Spousal Support and Alimony

Just as there are rights, there are also legal obligations that both parties must fulfill when it comes to spousal support and alimony:

Obligations of the Paying Spouse

The paying spouse has a legal obligation to fulfill their financial responsibilities by making timely payments as ordered by the court. This obligation extends beyond simply writing a check each month. The paying spouse must ensure that the payments are made on time, without delay or interruption. They must also keep accurate records of the payments made, providing proof of payment if required.

Furthermore, the paying spouse has a responsibility to inform the court of any changes in their financial circumstances that may affect their ability to make the required payments. This includes changes in income, employment status, or any other relevant financial changes. By keeping the court informed, the paying spouse can work with the court to modify the spousal support or alimony arrangement if necessary.

Failure to meet these obligations can result in legal consequences. The court has the power to enforce payment by various means, such as wage garnishment or seizing assets. In more severe cases, the court may hold the paying spouse in contempt, which can lead to fines or even imprisonment.

Obligations of the Receiving Spouse

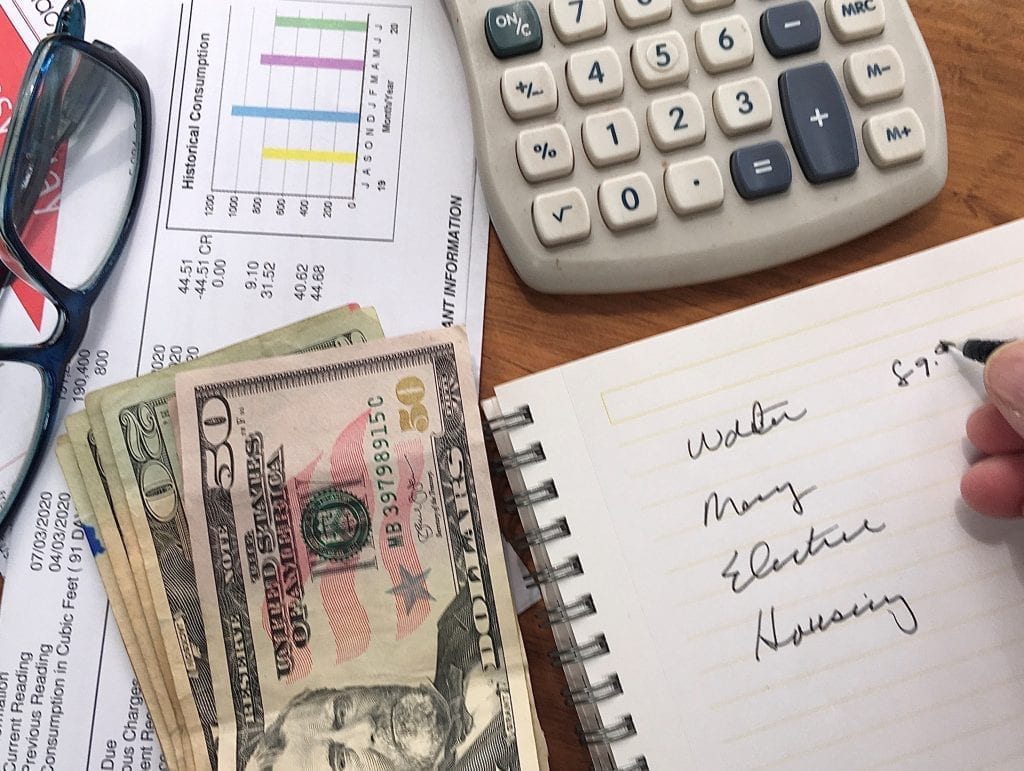

The receiving spouse also has legal obligations when it comes to spousal support and alimony. While they may be entitled to financial support, they have a responsibility to use the support they receive in a reasonable manner. This means using the funds for necessary expenses, such as housing, utilities, and healthcare, rather than frivolous or unnecessary purchases.

In addition, the receiving spouse has an obligation to make efforts to become self-sufficient if possible. This may involve seeking employment, further education, or vocational training to enhance their skills and increase their earning potential. By actively working towards self-sufficiency, the receiving spouse can reduce their reliance on spousal support or alimony over time.

Another obligation of the receiving spouse is to provide accurate and up-to-date financial information when requested by the court. This includes disclosing all sources of income, assets, and liabilities. By providing complete and truthful financial information, the receiving spouse allows the court to make fair and informed decisions regarding spousal support or alimony.

Failure to fulfill these obligations can have consequences for the receiving spouse as well. If it is found that the support received is being misused or that the receiving spouse is not making reasonable efforts to become self-sufficient, the court may modify or terminate the spousal support or alimony arrangement.

In conclusion, both the paying spouse and the receiving spouse have important legal obligations when it comes to spousal support and alimony. By fulfilling these obligations, both parties can ensure a fair and equitable resolution to their financial matters.

Factors Influencing Spousal Support and Alimony

When determining the amount and duration of spousal support and alimony, several factors come into play:

Duration of the Marriage

The length of the marriage is an essential consideration when calculating spousal support. Typically, longer marriages will more likely result in longer-term support payments.

For example, in a marriage that lasted for only a few years, the court may award temporary spousal support to help the lower-earning spouse transition into financial independence. However, in a marriage that lasted for several decades, the court may award long-term or even permanent spousal support to ensure that the lower-earning spouse can maintain a similar standard of living.

Financial Circumstances of Both Parties

The financial circumstances of both parties, including their income, assets, and earning potential, are crucial factors in determining the amount and duration of spousal support. Courts will assess the ability of each spouse to support themselves and make equitable decisions based on the available resources.

When evaluating the financial circumstances, the court will consider various factors such as the income disparity between the spouses, the standard of living during the marriage, and the potential for future income growth. If one spouse has significantly higher earning potential, the court may award higher spousal support to bridge the financial gap and ensure a fair outcome.

In addition to income, the court will also consider the assets and property owned by each spouse. If one spouse has substantial assets or property, the court may take that into account when determining the amount and duration of spousal support. For example, if a spouse owns multiple properties or has significant investments, the court may award lower spousal support payments as the assets can generate income for the recipient spouse.

Earning potential is another critical factor. If one spouse has the ability to earn a higher income but is currently unemployed or underemployed, the court may consider their potential income when calculating spousal support. This approach aims to encourage self-sufficiency and prevent the recipient spouse from becoming overly dependent on support payments.

Overall, the financial circumstances of both parties play a significant role in determining spousal support and alimony. The court strives to achieve a fair and reasonable outcome that considers the financial needs and abilities of each spouse.

Modifying and Terminating Spousal Support and Alimony

Spousal support and alimony orders are not set in stone. There are circumstances in which modifications or termination may be warranted:

Conditions for Modification

If there are substantial changes in circumstances, either party can request a modification of the support order. These changes may include the loss of a job, a significant increase or decrease in income, or a change in the custodial arrangement of children.

Conditions for Termination

Spousal support and alimony can be terminated under specific circumstances, such as the remarriage or cohabitation of the receiving spouse, their significant increase in income, or the death of either party. These events may result in the court reassessing the need for ongoing support.

Understanding the legal rights and obligations surrounding spousal support and alimony is crucial for anyone going through a divorce or separation. It is essential to consult with an experienced family law attorney to ensure a fair resolution that protects the interests of both parties involved.